Dear everyone,

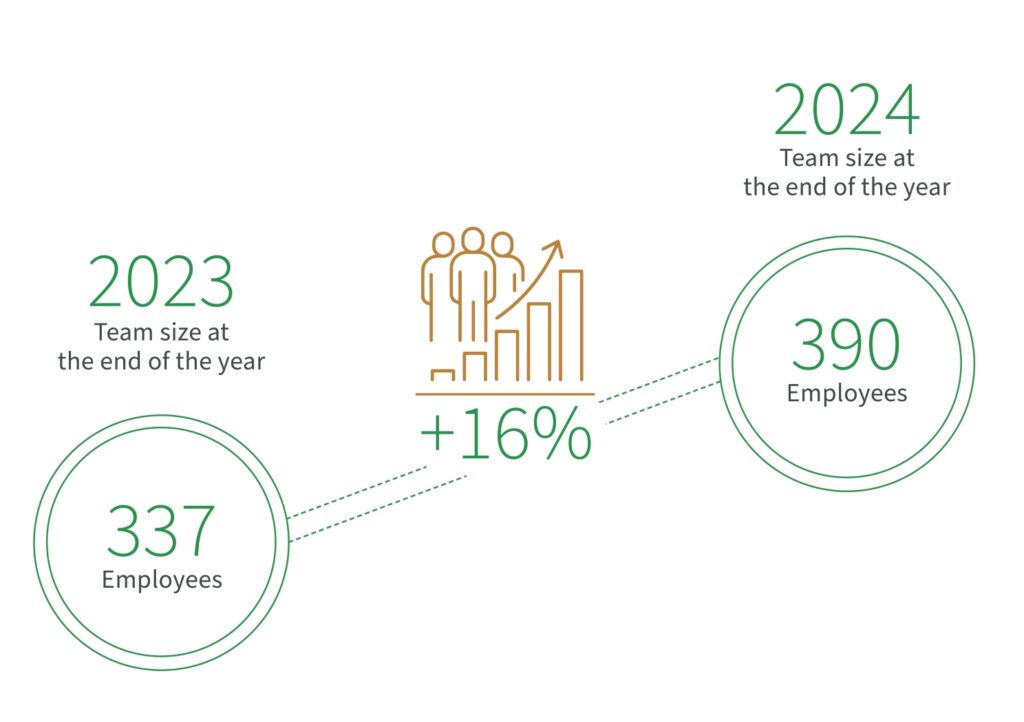

As 2024 comes to an end, we are delighted to share our highlights of the year with you. Amidst what continued to be a challenging market, this has been a year of further growth and achievements here at AURELIUS. Fundamental to this has been the dedication and passion of our team, which incidentally has grown too and now comprises 390 professionals across all investment strategies and offices.

While a persistent price gap has impeded a full recovery of deal volumes, AURELIUS’ proven expertise in transforming businesses with untapped operational potential has allowed us to successfully navigate these conditions. Powered by our in-house 180+ specialist strong Operations Advisory team, we were able to create impact across our portfolio. But before we dive into more details, let’s look at some of the key themes which have shaped our year:

- We continued to expand our teams, strengthening both our Investment and Operations Advisory, the latter becoming the largest in-house advisory in the industry

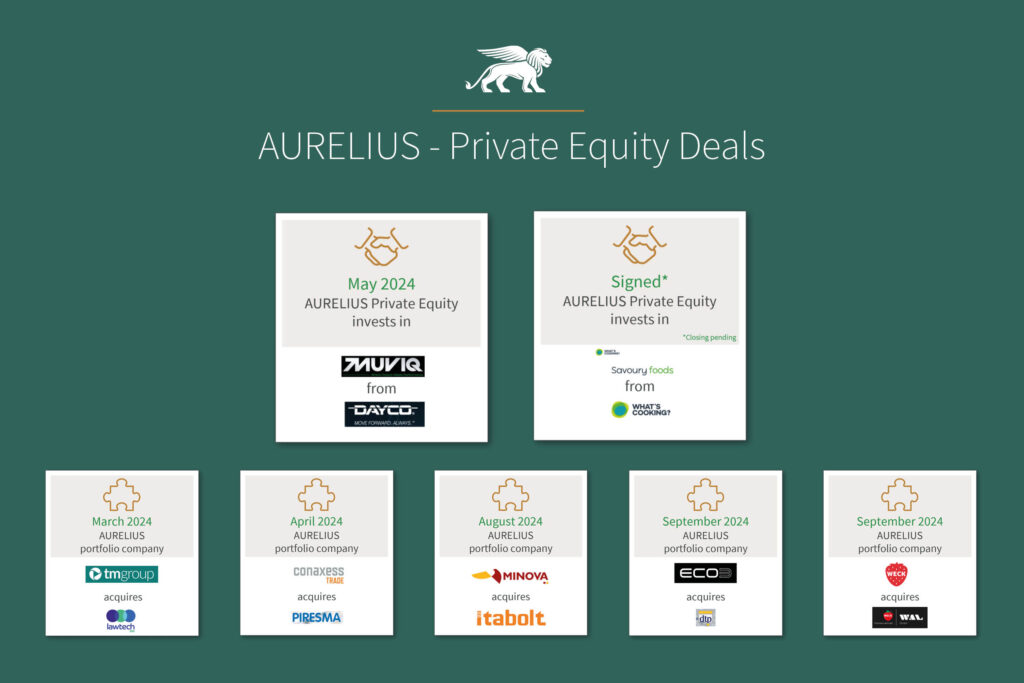

- We acquired two new platforms and five add-ons for AURELIUS Private Equity Mid-Market, as well as two platforms and 15 add-ons for AURELIUS Private Equity Growth. We also sold three companies from the AURELIUS portfolio

- We solidified and expanded our footprint in North America. Following the opening of an AURELIUS Investment Advisory office in New York, AURELIUS Operations Advisory is in the process of building a team based in Dallas

We have achieved all of this because the people at AURELIUS are driven by a spirit of entrepreneurship as well as a deep understanding of how businesses work and what advice really achieves success.

All of us at AURELIUS would like to thank you for your support in 2024. We will strive to maintain our momentum in transforming businesses and we wish you happy holidays and a successful, healthy, and happy New Year 2025!

Finally: if you would like to know more about AURELIUS’ predictions for 2025, check out the Outlook 2025 by Founding Partner Dirk Markus which will be published soon on our channels.

Building businesses through bespoke advice

While dealmaking is still a challenge in the current high-interest rate environment, AURELIUS has remained active throughout its investment strategies, also achieving three exits.

AURELIUS Private Equity Mid-Market acquired two new platforms, MUVIQ and more recently What’s Cooking Savoury Foods. Within the portfolio, the Investment Advisory completed five add-on acquisitions.

AURELIUS Growth Capital, a specialist in Buy & Build as well as Succession strategies, completed 15 add-on acquisitions to boost growth within its broad portfolio.

The Private Debt team at AURELIUS Finance Company completed four deals, providing financing facilities to clients such as Trutex, Trinny London and amscan.

Looking ahead, we anticipate a recovery in deal volumes during 2025, and we remain committed to seeking-out transactions with high potential for operational improvement, such as complex global corporate carve-outs.

A focus on opportunities: North America

AURELIUS has taken a big step in internationalising its footprint over the past year, with the establishment of our new office in New York. Stephan Mayerhausen, Managing Director at AURELIUS Investment Advisory and his team are now focused on identifying new investment opportunities in the dynamic North American Mid-Market.

With a growing team, the office will also relocate to its new address at 1270 6th Avenue in Q1 2025.

Spotlight on: MUVIQ acquisition

In May 2024, AURELIUS Private Equity acquired MUVIQ from Dayco Group, a company backed by financial sponsor Hidden Harbour Capital Partners. Formerly known as Dayco Propulsion Solutions, it has already been rebranded and is now supported by the team at AURELIUS Operations Advisory.

MUVIQ is a renowned power transmission system supplier to Commercial Vehicle & Off-Highway (CVOH) and Light Vehicle (LV) manufacturers (OEMs) with a global operational footprint, significant US focus and annual revenues of more than USD 460m in FY24. The carve-out was challenging from day one, with the main complexity being in IT – now simplified with the help of AURELIUS.

With its distinctive operational approach, the bespoke Aurelius Operating Model (AUROM) supporting the process and reducing complexity, AURELIUS is well suited to advise MUVIQ on its further transformation.

Continuing growth at AURELIUS

The AURELIUS team has grown steadily in recent years, and we are proud that this trend has continued in 2024. This year, we welcomed more than 60 new talents in eight offices to our team.

We are excited about the fresh perspective and energy our new colleagues bring and look forward to continuing our journey together. Today, over 390 professionals – including 180 operational specialists – work in 10 offices spanning Europe and North America.

We also welcomed Massimo Vendramini as new Managing Director Southern Europe at AURELIUS Investment Advisory. Massimo is based in our Milan office and, as an ex investment banker and senior private equity executive, brings to AURELIUS a wealth of experience in M&A and private equity, together with a strong network of relevant relationships in the local market.

Before joining AURELIUS, he led the origination and execution of several mid-market investments in Italy, focusing on businesses with international sales and operations, while also supporting subsequent add-ons and exit processes.

Events and awards

This year, we have significantly boosted our presence at industry events by attending SuperReturn in Berlin, Real Deals Value Creation and Private Equity Insights in London, among many others. These engagements have provided valuable opportunities to connect with industry peers, and are driving forward our business.

In addition, we are thrilled to have won Special Situations House of the Year and UK Small Cap Deal of the Year at the renowned Real Deals Private Equity Awards. These accolades highlight our commitment to operational excellence, navigating complex transactions, and delivering attractive returns for our investors.

A deep dive into our portfolio

The AURELIUS portfolio has a lot of great transformation stories to tell – and we are showcasing them! Have you already visited the Insights hub on our website to read more about how we create value with our distinctive approach?

Read more about our stories, including:

- TM Group | From dusty paper-based to tech enabled transactions [LINK]

- LSG Group | All systems Go for operational excellence [LINK]

- LSG Group | Flying high: The first year of independence [LINK]

- AAH Pharmaceuticals | Can digital boost success? [LINK]

- AAH Pharmaceuticals | How can I ensure, a carve-out succeeds? [LINK]

- Minova | Creating a leader: Independence is the golden ticket [LINK]

Hot off the press – our new Carve-Out Survey

We have just had the results of our annual Carve-Out Survey in, which are not only particularly decisive this year, but also benefit from a high number of respondents to make them statistically very solid. You will find the full survey on our website soon, but here is a quick peek:

There is great optimism in our community for an increase in the supply of non-core assets for sale in 2025, driven by sellers’ growing focus on their core businesses. This is reinforced by the expectation of half of respondents of a narrowing of the price gap and thus more deals. Buyers still seem cautious, however, when it comes to the type of asset they are looking for: almost 80% seek to buy Value targets rather than outright Growth. On the other side, the main characteristic sellers are looking for in a successful buyer is their ability to execute, which is clearly great for Execution Meister AURELIUS!

Our survey also detects a somewhat surprising indifference regarding the utility of AI for the identification and due diligence process ahead of a purchase, which nonetheless underscores our own contention that human judgement will continue to be crucial for the quality of GP decisions. More findings in the full Survey itself.

Outlook 2025

Dirk’s Outlook 2025 is still work in progress, but we already know that he expects a more dynamic PE market and more deals, amidst an economic and geopolitical backdrop that will continue to be really challenging. Other topics he will discuss are the narrowing of the price gap which currently still limits deal activity, the risks of regulation and taxation for our industry, the impact – and possible resolution – of funding challenges, ESG 2.0, and the opportunities and limitations of AI.